section 127 of income tax act

Exceptions to charge under section 583. Section 311 of the Act was classified to section 940a of Title 7 prior to repeal by Pub.

Pin By The Taxtalk On Income Tax Admissions Taxact Insurance

Amendment by section 111c4 of Pub.

. 1396b From the sums appropriated therefor the Secretary except as otherwise provided in this section shall pay to each State which has a plan approved under this title for each quarter beginning with the quarter commencing January 1 1966an amount equal to the Federal. 2 Act 2019 has inserted a new clause viii under Section 9 of the Income-tax Act to provide that any income arising outside India being money paid without consideration on or after 05-07-2019 by a person resident in India to. Person liable for tax under section.

2 - DIVISION A - Liability for Tax. Income charged under section 587. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules 12 - Inclusions 18 - Deductions 22 - Ceasing.

1 - Short Title. Income charged under section 583. The Income Tax Act CAP.

2 - PART I - Income Tax. 11 of 2004 15 of 2004 13 of 2005 6 of 2006 16 of 2007 1 of 2008 13 of 2008 14 of. C for the purposes of applying sections 37 65 to 664 667 111 and 126 subsections 1275 to 36 and section 1273 to the person the person is deemed to be a new corporation or trust.

A of this section and limits its membership to the members of a particular religion or to a club which in good faith limits its membership to the. The court also imposed a 10000 sanction under section 6673 for making frivolous arguments. Sales of patent rights.

332 RE 2019 9 _____ CHAPTER 332 _____ THE INCOME TAX ACT An Act to make provisions for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto. Of this title provides for a maximum amount of monthly compensation taxable under such Act during all. Of this section is exempt from income tax under subsec.

104127 title VII 780 Apr. To ensure that such gifts made by residents to a non-resident person are subjected to tax in India the Finance No. 3 - DIVISION B - Computation of Income.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. The court held that the petitioners argument was frivolous citing to section 1 imposes an income tax section 63 defines taxable income as gross income minus deductions and section 61 defines gross income. Charge to tax on income from sales of patent rights.

Income Tax Act No. Person liable for tax under section 583. 8997 applicable to calendar year 1966 or to any subsequent calendar year but only if by October 1 immediately preceding such calendar year the Railroad Retirement Tax Act section 3201 et seq.

Loading of goods destined for export on foreign-going vessels and aircraft and cross-border railway carriages114. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Effective Date of 1965 Amendment.

Compilation of Social Security Laws 1903. Orders permissible following conviction of person of offence contemplated in section 2 2. Charge to tax on income from disposals of know-how.

Notary Logo Design Attorney Branding Kit Lawyer Logo Scales Etsy In 2022 Branding Kit Law Branding Notary

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

Flat Interest Rate Vs Diminishing Balance Interest Rate Excel Based Calculator To Convert Between Flat Diminish Interest Rates Finance Guide Personal Loans

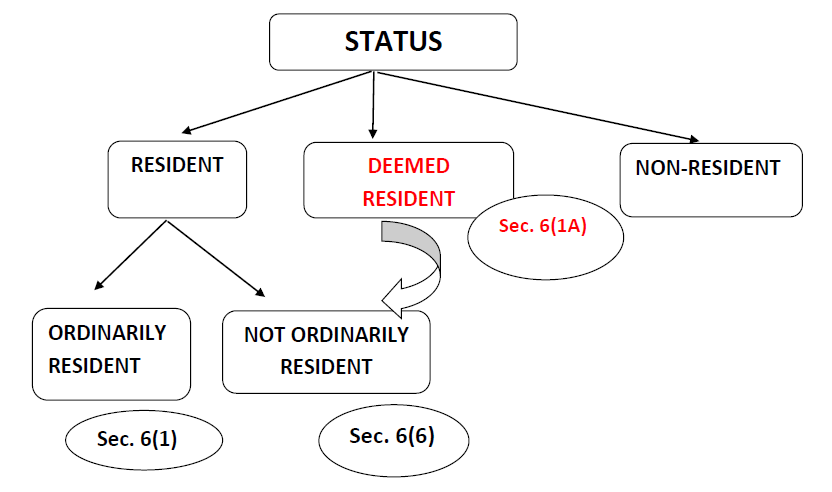

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Preparing Tax Returns For Inmates The Cpa Journal

No Dissolution Clause In The Trust Deed Whether Registration U S 12ab Can Be Denied The Proposition Taxact Clause

New York Issues Guidance On How To Report The Decoupling From The Cares Act On The Personal Income On Tax Forms It 201 It 203 It 204 And It 205

Irs To Reinstate Form 1099 Nec Requests Comments On Draft Apasnc Irs Teacher Resume Examples Irs Forms

Should Investors Encash Their Gains Finance Blog Investors Blog Updates

2021 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Turn Your Tax Refund Into A Nest Egg Tax Refund Online Business Tools Infographic

Business Deduction Under Section 43b Provision For Retention Bonus Disallowance Of Amount Not Paid Before Due Date For Filing Return Deduction Income Taxact

Income Tax Income Tax Tax Rules Tax Credits

No Withholding Tax On Commission Paid To Agents Outside India For Procuring Orders Agra Itat Taxact Tax The Outsiders

Pin By The Taxtalk On Income Tax In 2021 Income Tax Taxact Income

Order Passed By Assessing Officer In The Name Of The Assessee Without Specifying That The Income Is Chargeable To Tax In The Hands Of Assessment Income Taxact

No comments for "section 127 of income tax act"

Post a Comment